Selling your construction business in Orlando would be at a great time and position, with Orlando’s economy booming and growing faster than much of the rest of the United States last year. With the complex moving parts of selling your company, you want no misstep so that you can get the highest possible valuation. With expert brokers/M&A firms like ValleyBiggs, you can get top market value, and this is backed by a 100% success-based brokerage with no upfront fees.

Selling your construction business in Orlando, FL can be a daunting prospect. You might be concerned about securing a fair price, attracting genuine buyers, or even missing any legal detail that can put the negotiations at risk.

Let’s cut to the chase for busy business owners like you, your best option is an M&A firm with over 20 years of experience, closing over $2 billion worth of transactions, and for added confidence, ValleyBiggs only earns after you sell – which shows our commitment to sell at maximum value, and at the most reasonable amount of time.

To be transparent though, this page will guide you through each step of the process. We’ll share how to value your company, get your paperwork in order, find qualified buyers, and close your sale with confidence.

Key Takeaways

- Orlando’s construction market is experiencing a boom, driven by $10 billion in upcoming projects, significant job and population growth (76,000 new residents between July 2023 and July 2024), and robust GDP gains of 4.5% in 2023.

- To achieve the best selling price for your business, it’s crucial to prepare at least three years of financial records, maintain a healthy project backlog, and establish a skilled management team capable of independent daily operations.

- Business valuation can be determined through asset-, market-, or income-based methods; transparent financials and consistent contracts significantly enhance your company’s appeal to potential buyers.

- Experts like ValleyBiggs are important—they use current local data (from OEP as of December 2024/March 2025) to guide each sale step-by-step. They offer a success-based fee model—no payment unless your deal closes.

- Marketing through trade shows at Orange County Convention Center (230+ events yearly) brings attention from U.S. and international buyers; strict privacy keeps sensitive details safe during the sales process.

Understanding the Orlando Construction Business Market

Orlando’s construction industry keeps growing, with more buyers looking for companies ready to scale. Local market analysis and business valuation tools help you spot trends—giving your sale real power.

Key industry trends in Central Florida

Economic growth in Central Florida is strong. Retail, healthcare, real estate, and leisure made up 44 percent of Orlando’s economy in 2023. These sectors drove over 61 percent of its economic growth last year.

Tourism is a significant economic driver in the region, with approximately one-third of the local economy dependent on annual visitors, largely due to its renowned theme parks.

Technology investment is rising fast. The tech sector now employs around 300,000 people across almost 2,000 companies here. Infrastructure improvements are ongoing with big investments in roads and automated transit systems through the Central Florida Automated Vehicle Partnership.

Virtual reality has become important too; local simulation technology helps train workers for both education and healthcare jobs, adding value to business services throughout the area.

Why Orlando is a prime location for business sales

Orlando leads the nation in population growth, job creation, and GDP gains among major U.S. regions. Over 43 million people visit each year through Orlando International Airport. The Orange County Convention Center brings in almost 1.5 million visitors annually to over 230 events, adding $2.3 billion to the local economy.

Orange County benefits significantly from tourism, with visitors contributing over $5 billion annually in state and local taxes, accounting for half of all sales tax revenue. This strong visitor economy, bolstered by major events such as the NFL Pro Bowl and NCAA tournaments, leads to increased hotel occupancy, job creation, and a sustained demand for new construction and infrastructure projects.

Upcoming projects worth over $10 billion include transit upgrades and airport expansions—making it a hotspot for business investment in construction industries.

Orlando is also known as the second-biggest trade show destination nationwide… so companies find steady work here due to tourism, urban expansion, strong employment opportunities, and rapid population influx—all factors that make selling a construction business highly attractive.

Assessing the Value of Your Construction Business

Your construction company’s worth depends on many market factors—sometimes, it even comes down to the quality of your contracts and steady cash flow. A thorough business valuation helps set realistic expectations and draws in serious buyers.

Methods for business valuation

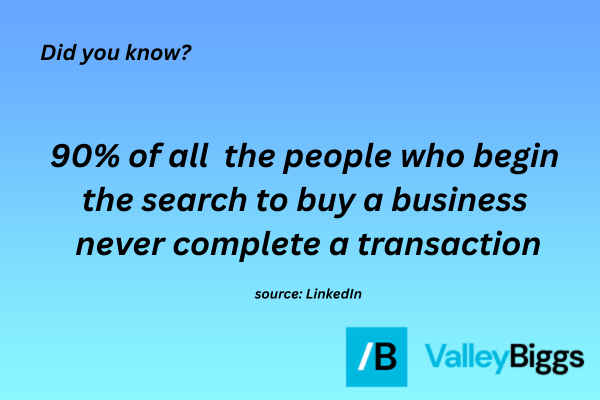

Proper valuation is crucial – statistics reveal that 75% of businesses are sold UNDERVALUED.

Most buyers and advisors use three main valuation methods: asset-based, market-based, and income-based approaches. Asset-based looks at the value of equipment, property, and materials minus debts.

Market analysis compares your company to similar construction businesses sold in Orlando’s fast-growing real estate sector.

Orlando’s construction companies offer strong investment potential due to the city’s robust GDP growth, which was up by 4.5% in 2023. The income method, which utilizes financial metrics such as cash flow or EBITDA, is used to forecast future profits..

Economic indicators such as regional output over $217 billion and rising business services also impact business assessment outcomes.

Recent data updates from December 2024 give investors a clear view of current conditions across industry sectors. Accurate economic valuation helps set fair prices that match market demand and project backlog strength.

Factors impacting the construction business’s worth

After looking at ways to value a business, it is key to know what drives that value up or down. Growth in the Orlando area, particularly across Lake and Orange counties, significantly influenced the above-average growth observed in 2023.

An influx of nearly 1,000 new residents each week fuels this expansion and consistently creates demand for both residential and commercial construction projects.

Large investments are also shaping business worth. Around $10 billion in upcoming infrastructure work—airports, ports, transit—signals strong future demand for building services.

The tech sector has about 2,000 companies with over 300,000 workers; this often leads to more service contracts for firms linked to real estate and development. A solid backlog of public-sector jobs exists too since one-third of Orlando’s economy comes from tourism, which steers spending toward hotels and event venues needing constant updates or expansion.

Each layer here directly impacts valuation by showing buyers the potential for stable cash flow and growth tied to local trends in investment and development.

In legal and negotiation matters, consider the following:

- Legal Pitfalls and Contracts: Review for potential legal issues and update contracts to ensure compliance with current regulations.

- Negotiation Challenges: Consult with legal professionals to address common challenges encountered during negotiations.

- Due Diligence Issues: Prepare contingency plans to manage any problems that may arise during the due diligence process.

Preparing Your Construction Business for Sale

Getting your construction business ready takes some focus—it’s about showing strong operations and future promise. Smart preparation helps market analysis tools work in your favor and makes valuation much more clear for potential buyers.

Organizing financial and operational documents

Buyers in Orlando look for clear financial documentation from the start. Compile at least three years of financial statements, including balance sheets, income statements, and tax returns. Up-to-date records are particularly crucial, especially considering Central Florida’s GDP growth in 2024, which indicates increased business activity.

Up-to-date payroll management files are key since the region is hiring over 23,000 new workers this year. Show accurate human resources data to give buyers confidence.

Project management paperwork must be easy to review too. Keep detailed records for all big infrastructure projects—more than $10 billion worth are active now in Orlando. Include proof of compliance with local rules and tax laws; state and local visitor taxes top $5 billion each year here.

Add notes on community impact if your construction jobs relate to public assets or big events at the convention center, which hosts over 230 events yearly. Clean operational records help raise your business valuation and keep deals moving forward smoothly.

Building a strong management team

A skilled management team boosts your business value. Orlando’s economy has grown for three years in a row, which makes it easier to find leaders with strong management skills and experience.

The city’s tech sector employs about 300,000 people, creating a deep pool of talent for your construction business. Big companies like KPMG and AAA prove that executive talent is available right here.

Orlando’s job growth rate hit 2.5% in 2024, so the competition for top managers stays high. The region attracts ambitious workers and innovation experts thanks to OEP’s focus on global competitiveness and its Orlando 2045 plan.

This diverse workforce includes engineers, project managers, entrepreneurs, and skilled labor teams ready to drive economic growth or lead during an ownership change. A robust leadership group helps show buyers your company can perform well without you running things day-to-day—making your business more attractive for expansion or acquisition.

Ensuring a healthy project backlog raises buyer confidence. Orlando’s booming construction industry gives big opportunities. Ongoing infrastructure projects worth $10 billion keep project backlogs full.

Orlando’s population growth of 2.7% in 2024 indicates a consistent need for new residential and commercial construction. Major events like the NFL Pro Bowl and WrestleMania drive continuous hospitality and entertainment renovations, providing year-round work for construction crews. Furthermore, the Orange County Convention Center’s upcoming 200,000-square-foot expansion guarantees additional future projects.

The city’s plans to make I-Drive into a walkable district bring more prospects for urban revitalization jobs and public works contracts backed by local visitor tax revenue. These factors show buyers that your business has stable income sources far into the future.

To ensure a successful sale of your construction business, focus on these key areas:

- Accurate Business Valuation: Determine your business’s true worth through realistic assessment methods such as EBITDA or revenue multiples.

- Comprehensive Financial Documentation: Prepare a minimum of three years of financial statements and tax returns to build buyer confidence and streamline the due diligence process.

- Robust Management Team: Strengthen your management structure to demonstrate the business’s ability to operate efficiently and independently.

- Demonstrate a strong project backlog of 6-12 months to assure buyers of predictable future revenue.

Building Your Deal Team

Your deal team drives the whole selling process—think of M&A advisors, legal counsel, and financial experts working together for your success. With support from ValleyBiggs, you get the whole deal team to provide guidance on market analysis, buyer acquisition, negotiation strategies, and owner transition…making every step clearer and more secure.

Partnering with ValleyBiggs: M&A experts and business brokers

Choosing expert M&A advisors helps guide business owners in Orlando’s fast-growing market. ValleyBiggs brings 20 years of experience with over $2 billion in closed deals for middle-market companies. ValleyBiggs has a 100% success-based service with no upfront fees, a testament to our confidence and commitment.

The team possesses the confidence and motivation to sell a business at its maximum potential, leveraging Orlando’s extensive experience across various industries. population growth, plus its diverse economic base.

Specialists at ValleyBiggs use strong benchmarks for business valuation and understand what attracts buyers, relying on up-to-date research from the OEP as of December 2024 and March 2025. Major new infrastructure projects boost demand for construction businesses.

Our success-based service means clients pay only if results happen; no upfront fees ever apply. Our experts connect sellers with top talent pools across the region, helping owners build a reliable deal team every step of the way.

Importance of legal and financial advisors

Legal and financial advisors play a big role in selling construction businesses in Orlando. The region’s $217 billion GDP brings complex deals, so expert transactional support is vital.

With over $10 billion tied up in infrastructure projects, you need advisors who understand real estate transactions and construction contract law. Public-private partnerships often use complicated legal frameworks that require careful review for compliance issues.

Orlando’s fast-growing labor market adds layers to human resources and tax considerations too. Major tax streams, like the $5+ billion from visitors and $260 million from the Tourist Development Tax alone, can affect deal structure.

Legal teams help with these compliance needs while also guiding economic diversification efforts backed by groups such as the OEP. Solid advice keeps your business sale on track as you move forward with building your full deal team.

A complete deal team includes:

To ensure a successful sale of your construction business in Florida, consider the following:

- Select a qualified firm: Partner with a firm that has expertise in the construction industry and a network of suitable buyers.

- Retain legal counsel: Engage an attorney who specializes in business sales and transactions within Florida to manage legal complexities and guarantee compliance.

- Collaborate with your accountant: Work closely with your accountant to prepare all required financial documentation and receive advice on tax implications.

All these are provided by us at ValleyBiggs, hence we are a full-stack M&A business brokerage firm. So you can just leave it to us worry-free.

The Selling Process with ValleyBiggs

Our advisors walk you through each step, handling every detail—from business listing to buyer acquisition. You get a custom plan, matched with the right negotiation strategies and full confidentiality…so your construction business in Orlando stands out on the local marketplace.

Step-by-step guide to the sales process

First, the OEP’s research and strategy team, led by Neil Hamilton, starts with fresh market data for every stage. They use new employment and population numbers from March 2025 to shape each step.

Active market analysis pinpoints strong buyer interest across Central Florida’s industry segments. Sales teams gather detailed records; these include up-to-date financials, a full list of assets, and critical contracts.

Guidance comes from both legal experts and CPAs at this point.

Targeted marketing strategies reach qualified buyers tied to Orlando’s diverse industries—contractors, developers, local investors. Buyer engagement stays structured due to over 230 annual events held at the convention center; each meeting is tracked for real progress.

Finding qualified/vetted buyers means no time wasted in proceeding with the sale.

Timelines stay grounded in current GDP growth rates and rising migration flows into Orlando. Negotiation tactics follow economic indicators like labor force numbers and upcoming infrastructure projects so sellers maximize value before closing deals with discretion every time…

Up next: effective ways to showcase your construction business directly to serious buyers in today’s vibrant market.

Marketing your business to qualified buyers

After following each step in the sales process, it’s time to bring your business in front of the right buyers. Orlando stands out as a top spot for getting the word out. The city is America’s second-largest trade show destination.

Over 230 events light up Orange County Convention Center every year, pulling in 1.5 million attendees. Showcasing your construction company at key industry shows or conventions boosts visibility fast.

Buyers from across the U.S., and even abroad, come through three international airports nearby. The convention center itself brings a $2.3 billion annual economic impact, proving strong market activity and interest from investors.

Major events like NFL Pro Bowl or WrestleMania grab national headlines and attract skilled talent to the area; this increases buyer pool reach for middle-market companies looking to grow through acquisition.

Orlando also offers over $10 billion lined up in future infrastructure projects, drawing attention from both local and international groups seeking new opportunities. With so many eyes on Central Florida—and a region well-known for customer service records (as shown by KPMG rankings)—your business looks even more attractive when presented professionally to qualified buyers ready to invest.

Confidentiality and discretion in the sales process

Moving from marketing your business to qualified buyers, the focus shifts to confidentiality and discretion. Stakeholder trust in Orlando is key, especially with big transitions or high-profile assets.

The Orlando 2045 process values careful handling of sensitive information. Only serious and vetted buyers see details about your construction business.

Orlando’s recent growth means more cross-border deals; 65% of 267,126 new residents since 2020 are international migrants. This makes strict privacy standards vital, not just for sellers but for community engagement too.

With global companies like KPMG and AAA in the region, professional conduct sets a high bar. ValleyBiggs follows strong rules to keep all data private during every step of a sale—protecting your company’s value while building prosperity through smooth transitions.

Maximizing the Sale Price

Smart planning, good market timing, and using strong negotiation tools can help boost your sale price—keep reading to discover how you can get the most from your construction business in Orlando.

Strategies to boost profitability and value

Orlando’s economy experienced robust growth in 2023, primarily fueled by the retail, healthcare, real estate, and hospitality sectors, which collectively accounted for 61% of the local economic expansion. This strong foundation provides a solid basis for enhancing profitability.

Construction companies can tap into public projects like sports centers or arts hubs fueled by new city investments. Leveraging Orlando’s $5 million sports fund and community developments often brings steady work and supports higher market valuation.

Diversifying your client base reduces risk and adds value; the OEP recommends this step to attract more buyers. Integrating construction technology is key—about 300,000 people work in Orlando’s tech scene, which makes it easy to add digital tools or simulation tech for faster project delivery.

Emphasize stable visitor revenue streams; half of Orange County’s sales tax comes from travelers, showing business strength even during slow periods.

Highlight inclusive job creation efforts and show off innovation wherever possible so buyers see your company as forward-thinking and ready for future growth.

Timing considerations for the Orlando market

Central Florida’s construction market experienced significant growth in 2023 and 2024, driven by increasing regional GDP, robust job creation, and a rising population, with over 76,000 new residents between July 2023 and July 2024.

The region’s appeal for real estate and construction deals is further enhanced by projects like $10 billion in planned or active infrastructure work. A strong seller’s market for well-managed businesses is indicated by the steady unemployment rate of just 3% in late 2024.

Periods of high in-migration or major project launches, such as the I-Drive corridor upgrades or the convention center expansion (adding over 200,000 square feet), typically lead to an increase in property values.

Long-term city plans, extending twenty years, aim to sustain investment while safeguarding against potential economic downturns.

Smart sellers keep an eye on these cycles; listing your business while market demand peaks can help maximize your sale price and capture broad investor interest across real estate and urban revitalization sectors.

To maximize your sale price, consider these strategies:

- Present your business’s strengths and potential clearly and compellingly.

- Engage experienced brokers to discreetly market your company to qualified buyers.

- Work with legal and financial advisors to negotiate optimal pricing and terms.

Why Choose ValleyBiggs to Sell Your Construction Business

ValleyBiggs brings deep market analysis, strong negotiation skills, and a focus on business valuation—discover how our team powers successful business sales in Orlando by reading more.

100% success-based service model

No upfront fees mean sellers pay only if the deal closes. This fee structure cuts risk for construction business owners in Orlando. Success is tied to actual transaction success, not empty promises or listing alone.

Prosperity-driven service helps align everyone’s goals with your business future—no payment unless you succeed.

Proven track record and expertise in construction M&A

This success-based model connects directly to a proven record in handling construction mergers and acquisitions. The firm is distinguished by its extensive experience in Florida’s rapidly expanding markets. Orlando, in particular, is experiencing a surge in demand for skilled M&A services within the construction sector, driven by $10 billion in new infrastructure spending.

ValleyBiggs was, in fact, cited by The Enterprise World as one of the biggest M&A firms internationally.

The team brings hands-on knowledge from deals shaped by real estate development, healthcare growth, and major projects tied to public events.

Insights come from working alongside economic plans like OEP’s Orlando 2045 vision; every move factors in local regulations and financial rules for smooth closings.

Strong ties with buyers and advisors who focus on high-tech fields help push deals through faster, often at higher values. The approach always highlights business valuation methods built for big-ticket construction and infrastructure companies—no guesswork here, just clear strategy backed by numbers that matter most to owners looking to sell.

Conclusion

Selling your construction business in Orlando can be seamless when you have a legal andfinancial team to lead you along the completion of the deal. Our 100% success-based service with no upfront fees shows our confidence and commitment to selling your construction business at the highest valuation in the most reasonable amount of time.

Getting help from experts at ValleyBiggs makes each part of the selling process easier and faster. A strong management team, good project pipeline, and organized records boost your business’s worth a lot.

FAQs

1. How do I start selling my construction company in Orlando, Florida?

Begin by compiling all financial statements and essential business documentation. Subsequently, engage with a local business broker specializing in the Orlando market, who can assist in pricing your business appropriately and identifying prospective buyers.

2. What steps should I take before listing my construction firm for sale?

Prior to listing, ensure your financial records are meticulously organized and address any outstanding legal or tax matters. Verify that all equipment is in optimal working condition, and update any necessary licenses and permits.

3. How long does it usually take to sell a building company in Orlando?

Selling a construction company typically has a timeframe of six months to a year or possibly two years, depending on several variables, such as the size of the company, the readiness and cooperation of the seller, and market conditions. The entire timeframe can be shortened with the assistance of expert brokers, as they already have a network of buyers and a streamlined process from valuation to documentation.

4. Can I keep my sale private when selling my construction service company?

To protect your team and clients, you can request confidentiality agreements from potential buyers. This ensures the news of the sale remains private until you decide to disclose it more broadly.